Federal depreciation calculator

The MACRS Depreciation Calculator uses the following basic formula. The calculator makes this calculation of course Asset Being Depreciated -.

Guide To The Macrs Depreciation Method Chamber Of Commerce

Use our capital gains calculator to determine how.

. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. All you need to do is input basic information like your. MACRS Depreciation Calculator Based on IRS Publication 946 Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate.

Depreciation in Any Period Cost - Salvage Life Partial year depreciation when the first year has M months is taken as. Our free MACRS depreciation calculator will provide your deduction for each year of the assets life. Because you can take advantage of 100 of this in the first year youll enjoy 62640 in tax savings the year.

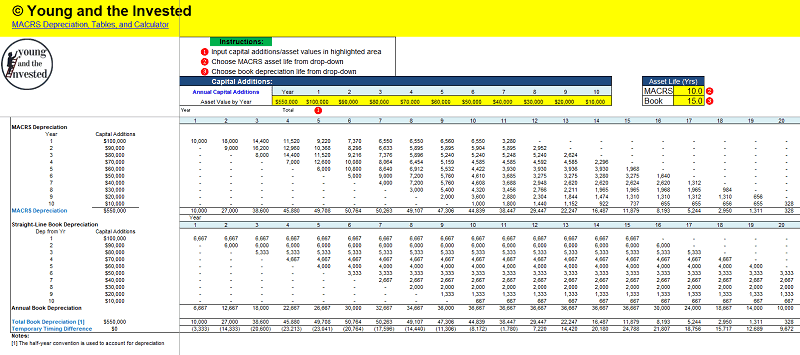

If your purchases exceed 27. This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods. It is not intended to be used for.

To get the full tax picture and impact of depreciation recapture lets. How much will car depreciation cost you. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property.

Vinny Federal Tax Payroll Withholding Calculator v2011 112 Vinny Federal Payroll Tax Calculator 2011 is a Windows utility for those that wants to calculate federal payroll withholding social. Section 179 deduction dollar limits. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation. And unlike ordinary income taxes your capital gain is generally determined by how long you hold an asset before you sell it. To determine the amount youll be taxed on your depreciation recapture use our depreciation recapture tax calculator.

This calculator performs calculation of depreciation according to. Let this calculator help you understand how the value of your car may be affected the longer you drive it. First one can choose the straight line method of.

25 x 250000 62500. Essentially CCA is a tax deduction. If your asset needs depreciating for more than 5 years calculate.

To calculate federal tax savings from depreciation multiply the 261000 by 24. It provides a couple different methods of depreciation. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of.

First year depreciation M 12 Cost - Salvage Life Last year. This calculator is for general education. For example if you have an asset.

For example the Canada Revenue Service CRA a federal tax agency in Canada provides the guide on the Capital Cost Allowance CCA. We also include the MACRS depreciation tables from the IRS and an. The depreciation recapture value is the amount of depreciation taken multiplied by a 25 rate.

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the. To use the calculator you will need to enter the value of the asset and then the percentage of depreciation for each year. Percentage Declining Balance Depreciation Calculator.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. For 2022 the maximum amount you may elect to deduct is 1080000 on qualifying property purchased and placed into service during the 2022 tax year. It is free to use requires only a.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. 100 Bonus Depreciation Ends December 31 2022 Bonus Depreciation Calculator The bonus depreciation calculator is on the right side of the page. This depreciation calculator is for calculating the depreciation schedule of an asset.

This depreciation calculator is for calculating the depreciation schedule of an asset. This limit is reduced by the amount by which the cost of.

Download Depreciation Calculator Excel Template Exceldatapro

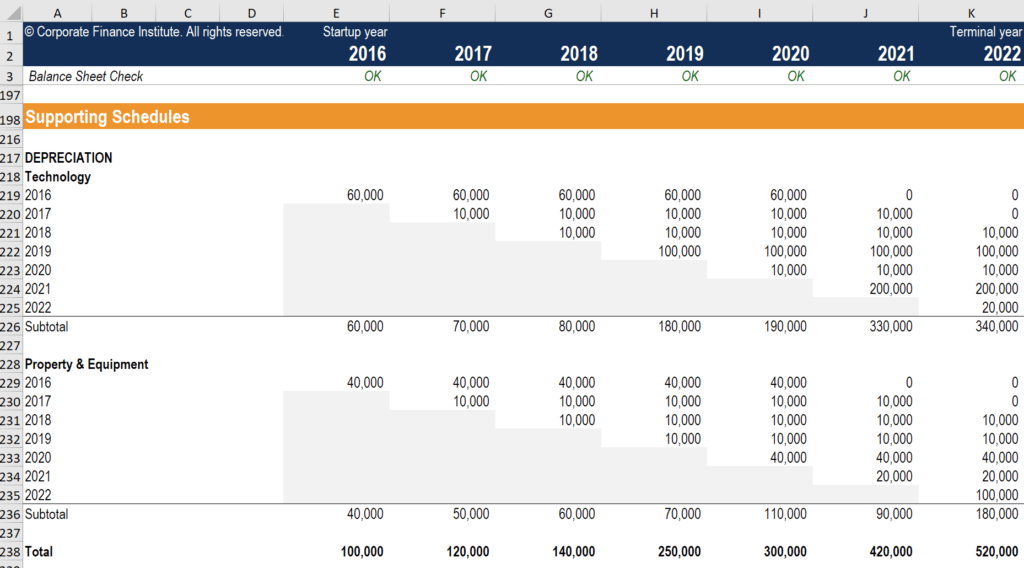

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator With Formula Nerd Counter

The Mathematics Of Macrs Depreciation

Download Depreciation Calculator Excel Template Exceldatapro

Implementing Macrs Depreciation In Excel Youtube

Macrs Depreciation Table Calculator The Complete Guide

Macrs Depreciation Calculator Straight Line Double Declining

Output Of The Macrs Depreciation Schedule For The Forklift Download Table

Depreciation What Is The Depreciation Expense

Depreciation Macrs Youtube

Depreciable Basis Depreciation Guru

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Schedule Guide Example Of How To Create A Schedule

Depreciation Formula Calculate Depreciation Expense

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Free Macrs Depreciation Calculator For Excel